Consumer Law Hinsights – April 2020 Edition

Hinshaw Newsletter | 6 min read

Apr 23, 2020

Welcome to Consumer Law Hinsights―a monthly compilation of nationwide consumer protection cases of interest to financial services and accounts receivable management companies. This edition highlights our interactive COVID-19 regulatory map and also includes an analysis from our blog, Consumer Crossroads, of the Second Circuit's decision in LaBoom and the deepening circuit split over what constitutes an automatic telephone dialing system (ATDS) under TCPA.

>>Download a printable version of the newsletter

You can also expand each of the topics below to read our full analysis of the cases and blog posts covered in this edition.

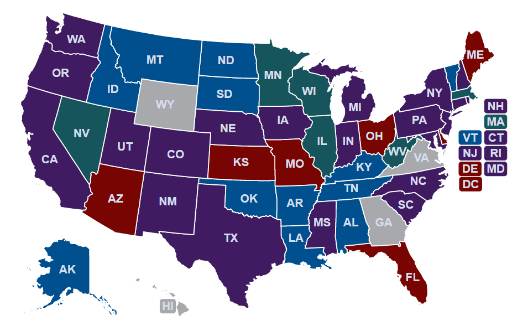

Tracking State Regulators' Response to COVID-19

To assist consumer financial services lenders, servicers, and investors, Hinshaw has developed an interactive tracker of state regulations related to the COVID-19 pandemic. The tracker documents actions by various state regulators, along with the limits imposed by states on foreclosures, evictions, and debt collections, and allows users to click on any state to view applicable provisions.  |

Second Circuit: Okay to Say You "May" Charge Interest so Long as There is a "Mere Existence of that Future Possibility"

A debt collector sent a collection letter with the common safe harbor disclosure: "Because of interest, late charges, and other charges that may vary from day to day, the amount due on the day you pay may be greater. Hence, if you pay the amount shown above, an adjustment may be necessary after we receive your check, in which event we will inform you before depositing the check for collection." Under the ever-expanding theory of the consumer bar, the debt collector was sued in a class action that alleged that the letter was false, deceptive, and misleading, because it suggested that late charges—and other charges—would be added when such charges were not legally or contractually recoverable. This disclosure was initially understood to provide safe harbor when the amount of the debt could change over time. However, recently decided confusing cases have explained that mentioning interest in conjunction with other charges could violate the FDCPA when interest cannot accrue, even when other charges can.

The district court dismissed the case and the Second Circuit considered the argument. The court disagreed with the consumer's allegation finding that, "[w]hile her amended complaint does allege that the addition of late charges and other charges are impossible, it does not allege that interest could not accrue. Rather, the amended complaint simply asserts that [debt collector] did not previously charge interest and did not intend to do so in the future. Even if there is no current intention to charge interest, the mere existence of that future possibility is completely consistent with the word 'may' in the Letter's language."

This opinion offers some welcome cover on this thinly sliced class theory where collectors are left to choose whether to include the language adopted by the courts when only one form of additional charges are available, even if remotely—or in this case, allegedly—not intended.

The case is Pettaway v. Nat'l Recovery Sols., LLC, No. 19-1453 (2d Cir. 2020).

Listing Interest and Charges at $0 and Totaling Amount as "Current Balance" Does Not Violate FDCPA

The debt collector sent a letter to the consumer seeking to collect the following:

- The total amount of the debt due as of charge-off: $10,536.94

- The total amount of interest accrued since charge-off: $0.00

- The total amount of non-interest charges or fees accrued since charge-off: $0.00

- The total amount of payments and credits made on the debt since charge-off: $0.00

- Current Balance: $10,536.94

Plaintiff's theory was that the itemization of the amounts breaking out interest and non-interest charges or fees, coupled with the use of the words "current balance," implied that the debt might increase, when in fact the amount was not increasing. Thus, the consumer claimed the letter violated the FDCPA.

The Eastern District of New York observed that the Second Circuit has held that "'if a collection notice correctly states a consumer's balance ... and no such interest or fees are accruing, then the notice will neither be misleading within the meaning of Section 1692e, nor fail to state accurately the amount of debt under Section 1692g.'" In this case, however, the letter plainly said no interest or other fees were accumulating on the debt because the letter "'clearly explained that no interest or fees had accrued ... and stated the balance owed.'" The court also pointed out that the total amount of debt due as of charge-off and current balance were listed as the same amount.

Ultimately, the court granted the debt collectors motion to dismiss reasoning that even if the consumer were to construe the term "current balance" to indicate that there were fees accruing on the remaining debt, "'the only harm . . . a consumer might suffer by mistakenly believing that interest or fees are accruing on a debt is being led to think that there is a financial benefit to making repayment sooner rather than later'. . .[s]uch harm 'falls short of the obvious danger facing consumers' in asserting a claim under the FDCPA."

The case is Shahin v. Client Servs., Inc., 19-cv-02070 (E.D.N.Y. Mar. 30, 2020).

Second Circuit: Letter Listing All Relevant Parties Failed to Identify to Whom Debt Was Owed

The debt collector in this case faced a growing problem of correctly identifying to whom the debt is owed while also trying to list the creditor involved in the transaction. The consumer obtained a Kohl's credit card that he failed to pay. The debt collector sent a letter identifying "Kohl's Department Stores Inc." as "Our Client" and "Chase Bank USA N.A." as the "Original Credit Grantor." Capital One had replaced Chase as the credit grantor on the Kohl's credit card. The letter did not state that Capital One owned the debt.

The consumer filed suit, alleging that the debt collector did not name the creditor to whom the debt is owed. The district court considered the fact that Kohl's actively serviced the account and was involved in the credit card program and hold that, "Kohl's is the 'creditor to whom the debt is owed,' and the failure to disclose the owner of the debt was not misleading because it would not have materially affected a consumer's decision-making process."

The U.S. Court of Appeals for the Second Circuit disagreed with the district court's conclusion. The Second Circuit found that the debt collector had not accurately provided the name of the creditor to whom the debt is owed. It stated the fact that Kohl's "participated in the credit card program with Capital One and played an active role in the servicing of accounts does not necessarily convert Kohl's into a creditor, and certainly not into the creditor to whom the debt is owed." Rather, the Second Circuit reasoned Capital One had replaced Chase as the "credit grantor," making Capital One—not Chase and certainly not Kohl's—the creditor to whom the debt was owed. Because the collection letter did not identify Capital One at all, the Second Circuit held that it did not comply with Section 1692g.

This case illustrates an increasing challenge in instances where the entity with whom the consumers would identify their account may not be the entity who issued the loan. Even innocent efforts to assist consumers in identifying the debt can run afoul of the technical mandates and restrictions of the FDCPA.

The case is Bryan v. Credit Control, LLC, No. 19-244-CV (2d Cir. Apr. 3, 2020).

Consumer Crossroads Blog | Quarterly Highlights

La Boom! Second Circuit Detonates Expanding Circuit Split over Auto-Dialer Definition Under TCPA

Hinshaw continues to monitor the deepening circuit split over what constitutes an automatic telephone dialing system (ATDS) under the Telephone Consumer Protection Act (TCPA), which restricts certain automated calls and text messages. To say there has been substantial debate by the courts and FCC concerning what constitutes an ATDS would be putting it lightly. And, just when it seemed a majority position was emerging, the playing field seems to have leveled with the Second Circuit's decision in Duran v. La Boom Disco, Inc... >>Read more

Popular Video Conferencing Zoom App Hit with CCPA Class Actions

We recently reported on the California Attorney General's ongoing and active enforcement of the California Consumer Privacy Act (CCPA) despite COVID-19 and the availability of private actions. In Robert Cullen v. Zoom Video Communications, Inc., N.D. Cal., No. 20-cv-02155, filed on March 30, 2020, plaintiff alleges that Zoom failed to properly safeguard the personal information of him and other users of its software application (Zoom App) and video conferencing platform… >>Read more

Related People

Featured Insights

Employment Law Observer

Dec 8, 2025

12 Days of California Labor and Employment: 2025 Year in Review

Press Release

Dec 4, 2025

Hinshaw Recognized by the Leadership Council for Legal Diversity as a 2025 Top Performer

Press Release

Nov 25, 2025

Hinshaw Legal Team Secures Summary Judgment in Gas Station Injury Case

Press Release

Nov 18, 2025

Hinshaw Releases the Third Edition of Duty to Defend: A Fifty-State Survey

In The News

Nov 13, 2025

A Profile on Neil Rollnick: After 57 Years in Practice, He Has No Plans to Retire

Press Release

Oct 22, 2025

Hinshaw & Culbertson LLP Launches New Website and Refreshed Brand