Insurance

Where Risk Meets Resolution: Strategic Counsel for the Insurance Industry

Why Hinshaw? Decades of Insight at the Heart of the Insurance Industry.

Hinshaw is internationally recognized as a leader in insurance law. Our attorneys counsel and defend leading domestic and international insurers – and have been appointed by insurers to represent their policyholders – across the full spectrum of commercial and personal policy lines and claim types. Our Global Insurance Services Practice Group boasts a deep bench of experienced insurance attorneys includes thought leaders who have shaped modern coverage law, former general counsel and in-house counsel, former regulators, and experienced trial and appellate lawyers who regularly appear before courts and regulatory bodies across the country. Insurers trust Hinshaw for our responsive guidance, seasoned advocacy, and bespoke solutions across areas impacting insurers, including:

- Insurance coverage and extra-contractual claims and coverage litigation

- Claims evaluation, resolution management and social inflation containment

- Regulatory compliance

- Reinsurance

- Corporate transactions

- Life, health, and disability

- Defending insurers and their policyholders in a wide range of litigation

Our integrated team of diverse lawyers have the experience insurers rely upon in jurisdictions and disciplines of interest. Most important, we deliver exceptional service and results on a consistent basis, addressing insurers’ needs comprehensively and effectively.

Areas of Focus

Global Reach and Strategic Alliances

Hinshaw's commitment to serving the insurance industry extends beyond national borders. Through our participation in the Global Access Lawyers network, we collaborate with leading insurance law firms worldwide to provide seamless legal support across jurisdictions. Additionally, our alliance with RPC, a renowned UK-based law firm, enhances our ability to offer comprehensive services to clients operating in the U.S., U.K., and Asia.

Built for the Business of Insurance

At Hinshaw, we understand that the insurance industry operates in a complex and ever-evolving environment. Our attorneys are not only legal experts but also industry insiders who bring practical insights and strategic foresight to every engagement. Whether navigating regulatory challenges, resolving disputes, or advising on policy matters, we are dedicated to delivering solutions that drive success for our clients.

To Find Out More Contact

Related Industries

Related Capabilities

- Bad Faith, Market Conduct & Extra-Contractual Liability

- Complex Commercial Litigation

- Construction

- Corporate & Transactions

- Data Privacy, AI & Cybersecurity

- Financial Services

- Government

- Healthcare

- International Law & Alliances

- Litigation & Trial

- Managed Care

- Nationwide Litigation Portfolio Management

- Real Estate

- Regulatory & Compliance

Featured Insights

Press Release

Jan 5, 2026

Experienced Insurance Partner Stacy Goldscher Joins Hinshaw in California

In The News

Dec 22, 2025

Scott Seaman Discusses Top Insurance Decisions From 2025 in Series of Law360 Reports

In The News

Dec 17, 2025

2025 Updated Primer on PFAS/Forever Chemical Claims and Insurance Coverage Issues

In The News

Dec 11, 2025

D&O Liability and Coverage: 2025 Trends, Developments, and Decisions

Press Release

Dec 4, 2025

Kevin Kelley Elected President of the Catholic Lawyers Guild of Chicago

Privacy, Cyber & AI Decoded Alert

Nov 24, 2025

Keep Calm and Prepare to Gobble On a New Feast of Privacy, Cyber and AI Laws

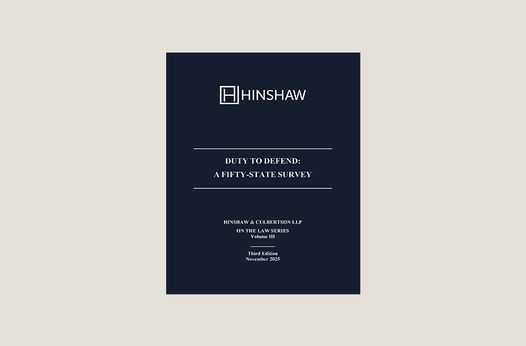

Press Release

Nov 18, 2025

Hinshaw Releases the Third Edition of Duty to Defend: A Fifty-State Survey

Insights for Insurers Alert

Nov 18, 2025

Navigating the Duty to Defend: Insights from the Third Edition of Hinshaw’s Fifty-State Survey